2. Access to cash

The majority of Group cash is held at the London or South African corporate centres. It is Group policy for excess cash balances to be repatriated to the corporate centres by way of dividends or deposits. The remaining cash balances are held by the businesses for local working capital purposes.

Cash held at the London corporate centre and certain businesses is primarily invested in highly rated, instant access USD-denominated money market and treasury funds. Cash held in South Africa is first applied inter-group and any residual cash is invested in rated money market funds, bank deposits as well as government bonds through repo transactions.

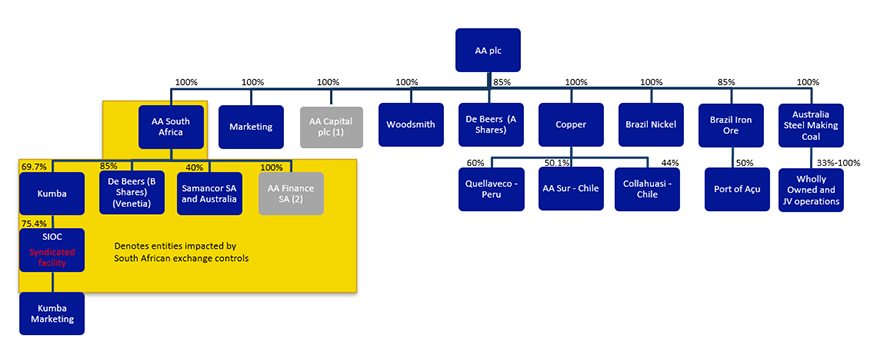

As the Group operates in South Africa, all subsidiaries of the Group registered in South Africa are subject to prevailing South African Exchange Control Regulations. These regulations are not expected to have a material effect on the ability of the Group to meet its ongoing obligations.

At 31 December 2025, the Group maintained a liquidity position of $12.4bn comprised of $6.4bn of cash and $6.0bn of undrawn committed bank facilities. Of the following committed bank facilities, only the Anglo American Capital plc Revolving Credit Facilities ($4.7bn) are guaranteed by Anglo American plc.

As at 31 December 2025, the material committed bank facilities(1) comprised the following:

| Borrower |

Currency |

Total committed bank

facilities

(bn) |

Drawings under

committed facilities

(bn) |

Undrawn committed facilities

(bn) |

Maturity |

Financial Covenants |

|

Anglo American Capital

|

USD

|

1.0

|

-

|

1.0

|

2025

|

No

|

|

Anglo American Capital

|

USD

|

3.7

|

-

|

3.7

|

2030

|

No

|

|

Anglo American South Africa

|

ZAR

|

8.8

|

-

|

8.8(2)

|

2026-2028

|

Yes

|

|

Kumba Iron Ore

|

ZAR

|

8.0

|

-

|

8.0

|

2029 |

Yes

|

1. Material committed bank facilities at fully consolidated entities of the Group.

2. Includes ZAR2.2 billion in respect of facilities with 12 month maturity which roll automatically on a daily basis, unless notice is served, ZAR1.5 billion in respect of facilities with 18 month maturity which roll automatically on a daily basis, unless notice is served. and ZAR 5.1bn in respect of facilities with 36 month maturity which roll automatically on a daily basis, unless notice is served.